ohio sales tax exemption form reasons

All retail sales are subject to the tax unless they are specifically excepted or exempted in Ohios sales tax law. Complete IRS Tax Forms Online or Print Government Tax Documents.

Ohio Tax Exempt Form For Farmers Fill Online Printable Fillable Blank Pdffiller

A Salvage Dealer Permit and Vendor License are required.

. Per Ohio Administrative Code 5703-9-14 F1 a taxpayer that operates as both a manufacturer and a. Step 3 Describe the reason for claiming the sales tax exemption. The sales and use tax is Ohios second-largest source of revenue.

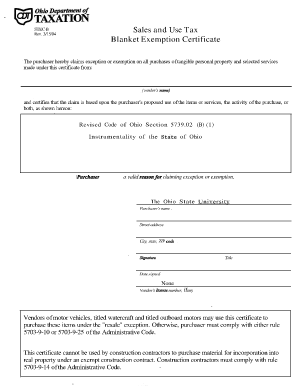

Step 3 - Describe the reason for claiming the sales tax exemption. The reason for exemption would be Use in manufacturing. Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of.

Ohio Sales Tax Exemption Form. An example reason for the purposes of completing the form could read purchases used for agriculture horticulture or floriculture production. The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines.

Sales Tax By Zip Code California. This page discusses various sales tax exemptions in Ohio. Top Metal Fabrication Companies Top Steakhouses In St Louis Top 10 Steakhouses Near Me.

OH Off-Highway Motorcycle An exemption applies to off-highway motorcycles purchased prior to July 1 1999 which is when the requirement to title these vehicles came into effect. Food consumed in a restaurant is also subject to sales tax. It is a statutory exemption from sales tax laid out in 573902 B42g for specific items used in a.

Top 100 Nonprofit Organizations Top Rated Pest Control Companies Top Rated Pest Control Services. 573902B1 SR Salvage Resale A salvage dealer taking a salvage title to a vehicle that is to be dismantled and sold as parts may claim an exemption from sales tax. Sales and use tax.

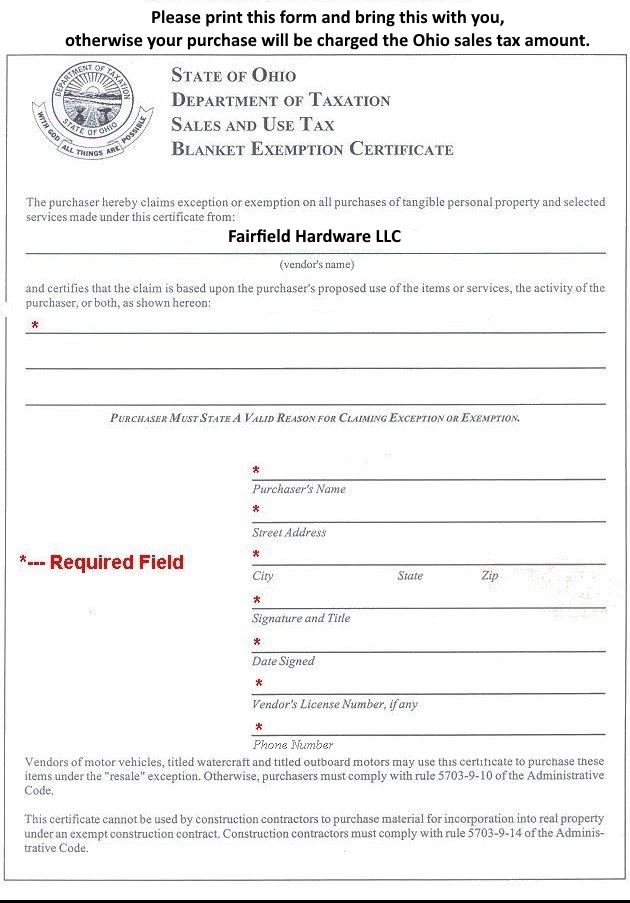

2 What sales are exemptexcepted from sales. If purchasing merchandise for resale some wording regarding the resale of products will. Sales and Use Tax Blanket Exemption Certificate.

These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock. The Ohio sales tax exemption for manufacturing is broad and encompasses a wide array of purchases used in the manufacturing process. Be sure that you are not paying sales tax on.

Offer helpful instructions and related details about Tax Exemption Reasons In Ohio - make it easier for users to find business information than ever. These forms may be downloaded on this page. Ohio Unemployment Information Sheet.

Sales tax exemption in the state applies to certain types of. Prior to this sales tax was paid directly to the Treasurer of State not the local Clerk of Courts title office. 1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App.

While the Ohio sales tax of 575 applies to most transactions there are certain items that may be exempt from taxation. Offer helpful instructions and related details about Ohio Sales Tax Exemption Certificate Reasons - make it easier for users to find business information than ever. Vendors name and certifi or both as shown hereon.

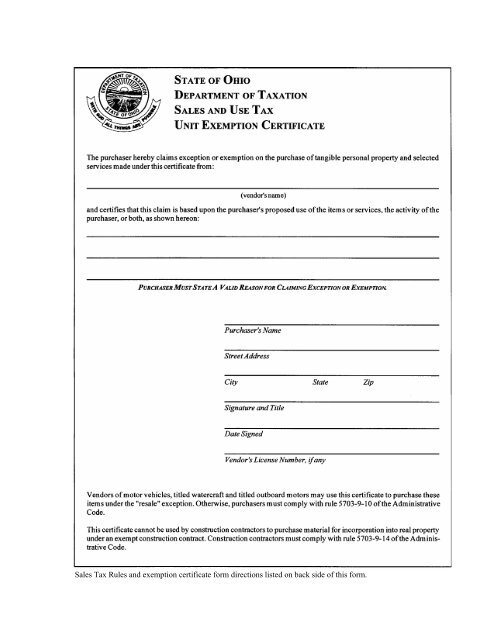

Ohio sales tax exemption form pdfPurchaser must state a valid reason for claiming exception or exemption. To qualify as a tax-exempt nonprofit organization in Ohio the organization must obtain tax-exempt status from the Internal. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions.

Top Rated Pest Control Companies Top Rated Pest Control Services Top 5 Restaurants In Austin Texas. Ad Vast Library of Fillable Legal Documents. The state sales and use tax rate has been 55 percent since July 1 2005.

The Ohio sales and use tax dates back to 1934 when the Ohio General Assembly enacted its first tax at 3. This represents a significant and important. 573902 B 42 g provides an Ohio sales tax exemption when the purpose of the purchaser is to use the thing transferred primarily in a manufacturing operation to produce tangible.

Reasons for Tax Exemption in Ohio eHow. Best Tool to Create Edit Share PDFs. Offer helpful instructions and related details about Reasons For Tax Exemption Ohio - make it easier for users to find business information than ever.

This represents a significant and important savings that manufacturers shouldnt overlook. The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process free from the Ohio sales and use tax. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Purchaser must state a valid reason for claiming exception or exemption. On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. Step 2 - Enter the vendors name.

Step 1 - Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. Education aug 16 2019 to claim the ohio sales tax exemption for manufacturing qualifying manufacturers need to complete ohio sales tax. A taxable sale includes any transaction in which title or possession of tangible personal property or the benefit of certain services is or will be transferred or provided for a price.

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. Step 2 Enter the vendors name. The purpose of this article is to help clarify the Ohio Sales Tax Exemption for Ohio Farmers.

The Unit Exemption Certificate is utilized for the majority of tax exempt purchasing procedures and the Blanket Exemption Certificate is the blanket version of this form. Though most food and drink are exempt from sales and use tax alcoholic beverages soft drinks tobacco and dietary supplements are all subject to taxation. Ohio Revenue Code Ann.

In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Ohio Sales Tax Exemption Form. A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code.

Sales Tax Exemptions in Ohio. A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has one.

Farm Bag Supply Supplier Of Agricultural Film

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Printable Ohio Sales Tax Exemption Certificates

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Form Stec B Fillable Sales And Use Tax Blanket Exemption Certificate

Ohio Tax Exempt Form Holland Computers Inc

Fairfield Hardware Ohio Tax Exemption Form

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Form Stec U Fillable Sales And Use Tax Unit Exemption Certificate